pay indiana tax warrant online

Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week. Was this article helpful.

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own

Make a Payment via INTIME INTIME user guides are available if needed.

. If you have an account or would like to create one or if you would like to pay with Google Pay PayPal or PayPalCredit Click Here. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. The Sheriff of Porter County is authorized to collect taxes due to the State of Indiana.

Create an INtax Account. The terms of your payment plan depend on who is collecting your Indiana tax debt. Doxpop provides access to over 13062400 current and historical tax warrants in 92 Indiana counties.

INtax only remains available to file and pay the following tax obligations until July 8 2022. Send in a payment by the due date with a check or money order. Find Indiana tax forms.

The Sheriff will post any changes to this Privacy Policy online on or before the effective date of such changes. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. 731 out of 1435 found this helpful.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Revenue Department of 19 Articles. You should also know the amount due.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247. Why did I receive a tax bill for underpaying my estimated taxes. What ATWS Users Are Saying.

Questions regarding your account may be forwarded to DOR at 317 232-2240. Hamilton County Sheriffs Office 18100 Cumberland Road. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247.

Ready to access the Indiana Taxpayer Information Management Engine INTIME. Acceptable Forms of Payment by Mail or in Office. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to.

INTAX only remains available to file and pay special tax obligations until July 8 2022. DOR Online Services Pay Taxes Electronically INTIME INTIME provides access to manage and pay individual income and various corporate and business tax obligations. Office of Trial Court Technology.

Tax Warrant Payment Methods. Tax Return Payment IT-40 and click next. Indygov Pay Your Property Taxes This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card.

If you wish to dispute the amount owed please contact the Indiana Department of Revenue directly in Indianapolis at 317 232-2165 or their Merrillville branch located at 1411 E 85th Ave Merrillville IN 46410 219 769-4267. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. Search for your property Search by address Search by parcel number.

If you have discarded that statement you will need to contact the Putnam County Treasurers office at 765 653-4510 to request your. Where do I go for tax forms. For more information visit INTIME.

You can pay online by visiting httpsintimedoringoveServices. Pay the amount of tax due as a result of filing an Indiana individual income tax return. Cash Please do not mail cash CreditDebit Cards Please do not mail debitcredit card information Money Order.

Pay indiana tax warrant online - Erna Ayala pay indiana tax warrant online Tuesday March 8 2022 Take the renters deduction. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply. Please make your 2016 Individual Tax Payment here.

Where can I get information about the 125 Automatic Taxpayer Refund. Personal Business or Cashiers Check. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill.

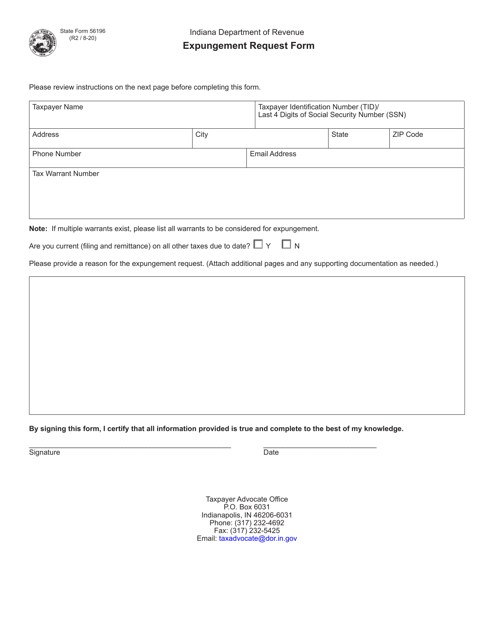

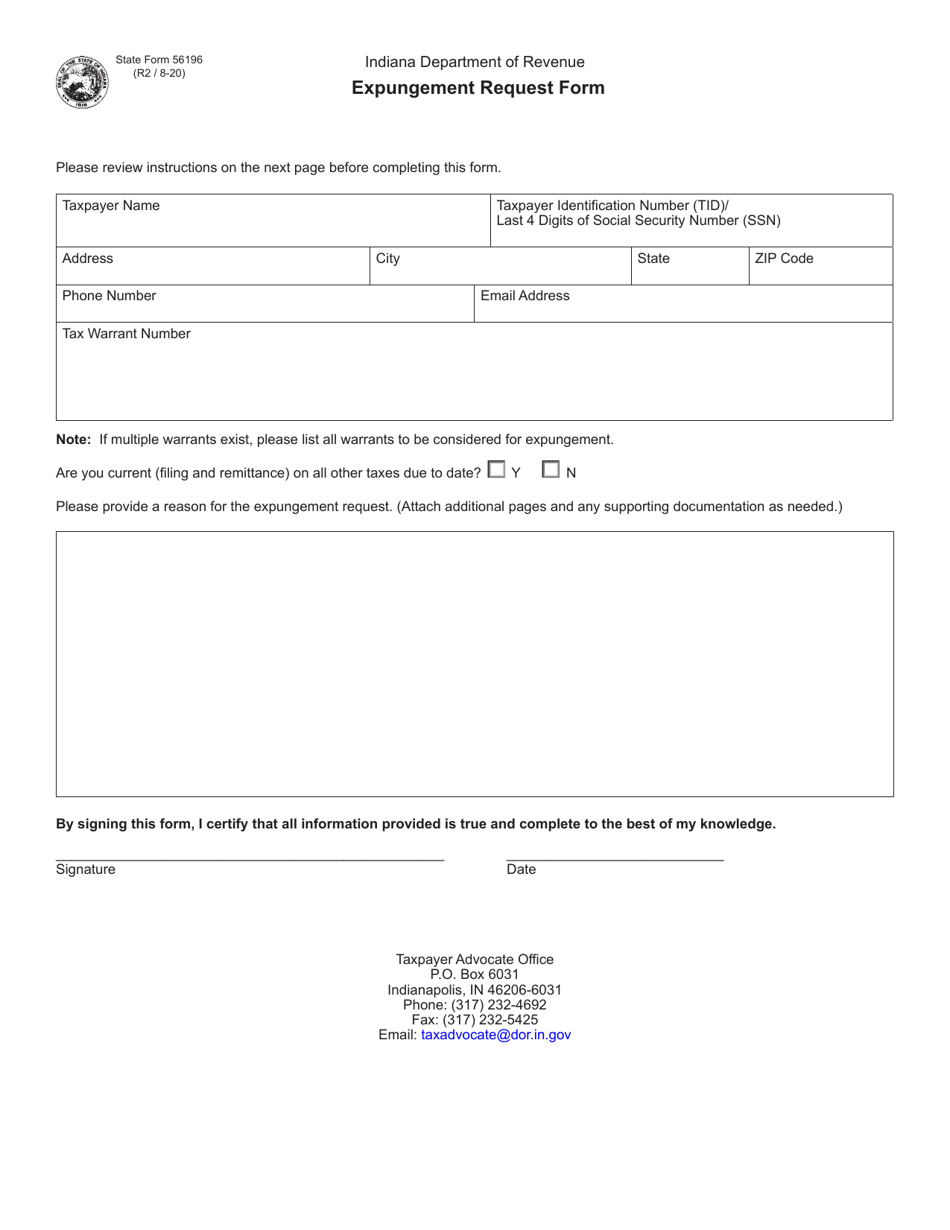

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Completed Expungement Request Forms and supporting documentation may be returned to taxadvocatedoringov or via mail to. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed.

Individual income tax payment. On the next screen select. Mail - Payable to.

Our service is available 24 hours a day 7 days a week from any location. When you receive a tax bill you have several options. Take the renters deduction.

This can be found on your tax bill that was mailed to you from the Putnam County Treasurer. Tax Liabilities and Case Payments. If You Cant Pay It Now Pay It Over Time If you cant pay your Indiana tax balance in full immediately you likely can set up a payment plan.

E-Tax Warrant Search Services. State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller Claim a gambling loss on my Indiana return. Indiana Department of Revenue.

Illinois Street Suite 700. ATWS is a software package that streamlines the handling of Indiana Tax Warrants. You are now in the right spot to pay your state tax balance.

Submit the form and well contact you with more information on how your Indiana County can benefit from ATWS. Lieberman Technologies is proud to provide Indiana Sheriff offices with Automated Tax Warrant System ATWS.

Tax Certificate And Tax Deed Sales Pinellas County Tax

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Dor Indiana Extends The Individual Filing And Payment Deadline

Dor Keep An Eye Out For Estimated Tax Payments

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Preparing Tax Returns For Inmates The Cpa Journal

Fraudulent Tax Debt Letters Claiming Distraint Warrant Are A Scam Randall County Says

4 Arrested In Randolph County While Executing Felony Warrants

Togo Powerful Disney Movie Shines New Light On A Truly Heroic Dog And Cleveland S Balto Too New Disney Movies Disney Movies Dog Movies

Child Tax Credit 2021 Payments How To Know If You Owe Irs Letter To Watch For

Dor Use Intime To Make Non Logged In Bill Payments

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own